1

Updated October 14, 2020

Aggressive State Outreach Can Help Reach the 12

Million Non-Filers Eligible for Stimulus Payments

By Chuck Marr, Kris Cox, Kathleen Bryant, Stacy Dean, Roxy Caines, and Arloc Sherman

About 12 million Americans risk missing out on the

stimulus payments provided through the recent

CARES Act because they, unlike millions of people

who are receiving the payments automatically from

the IRS, must file a form by November 21 to receive

it. (This estimate, based on CBPP analysis of Census

data, is approximate; please see Appendix II for our

methodology.)

1

This group includes very low-income

families with children, people who have been

disconnected from work opportunities for a long

period, and many low-income adults not raising

children in their home.

Governors and other state officials can play a

central role in reaching these 12 million individuals,

up to 9 million of whom — roughly 3 in 4 —

participate in SNAP (formerly food stamps) or

Medicaid, which states and counties administer.

2

This group of non-filers eligible for payments are

disproportionately people of color because they are

likelier to have lower incomes due to historical racism

and ongoing bias and discrimination. Twenty-seven

percent of the 9 million people are Black — higher

than their share of the U.S. population (12 percent)

— while another 19 percent are Latino. Ensuring that

1

These estimates are affected by underreporting of income and benefits, recent changes in program participation, and

other data limitations.

2

We focus on SNAP and Medicaid because they are the two programs with the broadest eligibility and enrollment and

with funding structures that allow them to serve all eligible persons who apply. Many people eligible for the stimulus

1275 First Street NE, Suite 1200

Washington, DC 20002

Tel: 202-408-1080

Fax: 202-408-1056

center@cbpp.org

www.cbpp.org

2

low-income people of color receive the payments for which they qualify is especially important given

emerging evidence that they are being hit hardest by both the economic and health effects of the

pandemic.

The IRS, working with the Social Security Administration, Department of Veterans Affairs, and

Railroad Retirement Board, has been automatically delivering the CARES Act stimulus payments

(technically called Economic Impact Payments or EIPs) to tens of millions of people who regularly

file federal income taxes or receive certain federally administered benefits, such as Social Security,

Supplemental Security Income (SSI), Railroad Retirement, or Veterans Affairs pension or disability

benefits. Eligible adults receive $1,200 plus $500 for each eligible child.

But the automatic payment method misses about 12 million people — adults and children —

because they aren’t required to file federal income tax returns due to their low incomes and they do

not participate in one of those specified, federally administered programs.

3

Together, these people

are eligible to receive $12 billion in payments. (See Table 1 for state-by-state estimates.)

To receive the payments, these individuals must provide their information to the IRS no later than

October 15 through a 2019 tax return or by November 21 when using the IRS “Non-filer” tool, a

simplified online form for people not required to file a tax return.

4

The tool requires a user to create

an online account, enter certain personal information (including direct deposit information, if

available), verify their email address, and submit the form. The IRS plans to issue all payments

before the December 31, 2020 deadline in the CARES Act.

An aggressive outreach program is needed at the state and local levels to inform eligible

individuals, who by definition have very low incomes, that they are eligible and to help them

undertake the required steps. Such outreach efforts will benefit both individuals and communities.

The payments are considerable, both for the recipients and by other standards of assistance; in some

states, the amount of money at stake is as much as ten times the state’s total annual cash assistance

to families with children. These funds would go to extremely low-income individuals and families at

a time when need is rising due to the pandemic. And ensuring these people apply for and receive the

payments for which they qualify will also benefit local and state economies, in which much of the

money will be spent.

Governors and other state officials can play a vital role in reaching the 12 million eligible people.

The health and human services agencies that administer SNAP and Medicaid are uniquely positioned

to reach, using established communication channels, the subgroup of 9 million people who

participate in those two programs. Governors and state agencies can also do much to reach the

payments who are enrolled in SNAP and/or Medicaid also participate in other state-operated programs, most notably

cash assistance through Temporary Assistance for Needy Families.

3

The IRS issued over 159 million payments to households as of June 3, which includes both automatic payments and

payments to people who provided their information through the Non-filer form. Our estimate of 12 million people

refers to those who did not qualify for an automatic payment from the IRS. Some of these 12 million people may have

directly provided their information to the IRS after learning about their eligibility for the payment and already received

their payment as a result. Nevertheless it remains that up to 12 million people risk missing out if they don’t fill out the

Non-filer form by November 21.

4

Internal Revenue Service, “Non-Filers: Enter Payment Info Here,” updated May 18, 2020,

https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here

.

3

other 3 million eligible people, who generally do not receive state or federal benefits. Public

education efforts and partnerships with key stakeholder groups, such as service providers for people

experiencing homelessness, will be critical to connecting people to the $1,200 payments.

In addition, if federal policymakers issue additional stimulus payments to boost economic demand

and reduce hardship, state efforts now to connect eligible low-income individuals with the tax

system should pay dividends in helping these people access any future rounds of payments.

Background on Stimulus Payments

The CARES Act, signed into law on March 27, includes stimulus payments to support overall

consumer demand amidst historic job losses and business closures and to help families deal with the

fallout from the COVID-19 crisis. The payments are designed to be significant — $1,200 per adult

($2,400 for a married couple) and $500 per dependent child — and broad-based; unlike the

payments provided during the Great Recession,

5

they are available to people with the lowest

incomes. Moreover, there is no earnings test, so people with zero earnings are eligible for the full

amounts. The payments begin phasing out at incomes of $150,000 for married couples, $112,500 for

heads of households, and $75,000 for singles. Unfortunately, the law unreasonably excludes certain

groups from the payments. Immigrant families (except for certain military families) are ineligible if

any adult or spouse (if filing jointly) lacks a Social Security number. Also ineligible are 17-year-olds,

college students whom their parents can claim as dependents, and adult dependents.

To deliver these payments to the nation’s roughly 300 million eligible people, policymakers chose

the IRS, which has contact with a large share of the population. The payments, therefore, are

designed as a tax credit. They are “fully refundable,” meaning that eligible households receive the

full amount regardless of what — if anything — they pay in federal income tax. Importantly,

because the country is in the middle of a crisis, the law instructs the Secretary of the Treasury (who

oversees the IRS) to deliver the payments “as rapidly as possible.”

The IRS, working with other agencies, has been delivering the payments using a generally step-by-

step approach, starting with payments to the people easiest to reach. First up were people who filed

federal income tax returns in 2018 or 2019 and for whom the IRS had direct deposit information.

Then, the IRS began working with the Social Security Administration and the Railroad Retirement

Board to automatically deliver payments to retirees and persons with disabilities who receive Social

Security or Railroad Retirement benefits but do not typically file tax returns. Next up for automatic

payments were recipients of SSI or veterans’ pension or disability benefits who do not file tax

returns.

For these groups, the process of delivering payments has gone relatively smoothly, especially

considering the depleted state of the IRS after nearly a decade of funding cuts.

6

The challenge now is

to ensure that the remaining 12 million people, who neither file federal income tax returns nor

receive certain federal benefits, receive the payments for which they are eligible “as rapidly as

possible,” as the law mandates. In addition to developing the “Non-filer” tool described above for

5

Internal Revenue Service, “Economic Stimulus Payments On The Way; Some People Will See Direct Deposit

Payments Today,” April 28, 2008, https://www.irs.gov/pub/irs-news/ir-08-066.pdf

.

6

Samantha Washington, “IRS Stimulus Glitches Show Cost of Earlier Cuts,” Center on Budget and Policy Priorities,

April 28, 2020, https://www.cbpp.org/blog/irs-stimulus-glitches-show-cost-of-earlier-cuts

.

4

people who don’t typically file tax returns, the IRS has expanded its outreach efforts beyond its usual

partners to reach non-filers with low incomes and those in the military, veteran, and homeless

communities.

7

But many non-filers are not connected to traditional channels of information and are

likely to miss out on payments without additional efforts.

Remaining 12 Million Eligible People Have Very Low Incomes

By definition, the estimated 12 million people not receiving payments automatically have very low

incomes because they aren’t required to file federal income tax returns.

8

Only people with annual

income above the following levels have a legal obligation to file a return for 2020: $12,400 for singles,

$18,650 for heads of household (such as a single parent with children), and $24,800 for married

couples.

9

(Many people with incomes below those thresholds do file federal income tax returns in

order to claim the Earned Income Tax Credit [EITC] or Child Tax Credit. Low-income families

with children have an incentive to file a return to claim these tax credits, as do adults not raising

children in their homes, though to a lesser degree.

10

)

The 12 million group is predominantly non-elderly. Many senior citizens are receiving automatic

payments because they receive Social Security, Railroad Retirement, SSI, or veterans’ pensions or

disability benefits. Up to 1 million seniors, though, may be eligible for payments but do not receive

them automatically.

The outstanding payments amount to roughly $12 billion nationally, which — if delivered and

spent — would not only reduce hardship but also give state and local economies a much-needed

boost.

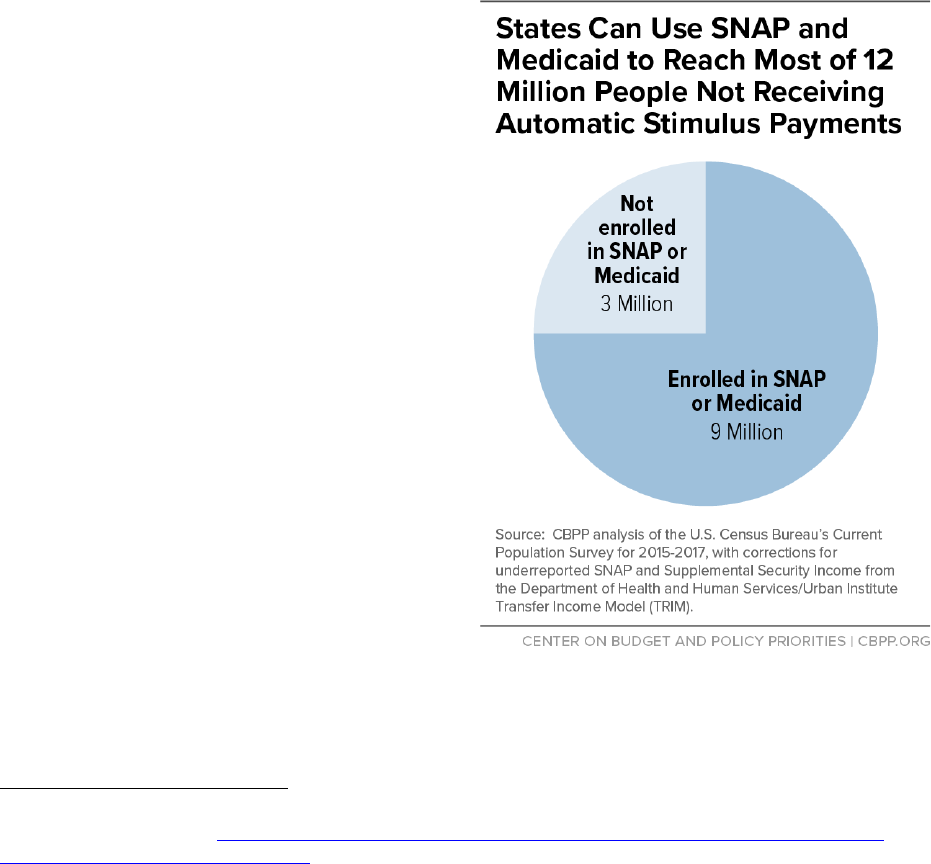

SNAP and Medicaid Agencies Can Reach About 9 Million Eligible People Not

Receiving Automatic Payments

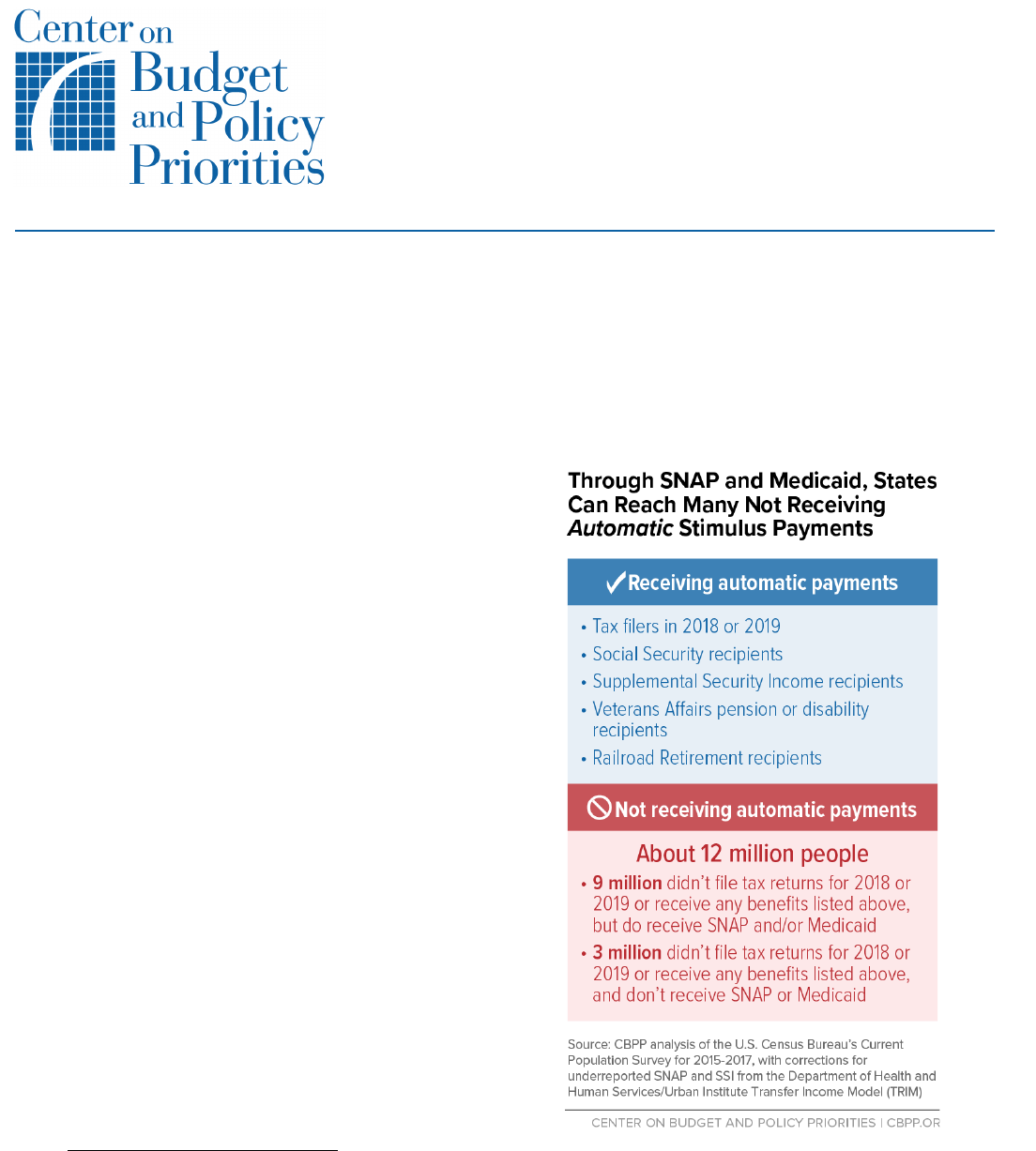

We estimate that approximately 9 million of the 12 million people who won’t automatically

receive the payments receive state- or county-administered benefits such as SNAP or Medicaid, a

fact that underscores the key role for state government in reaching this group. (See Figure 1.) They

have low incomes and are among those who most need the payments to cover essential expenses.

The payments for which they qualify, worth a combined $9 billion, represent a significant sum both

individually and collectively. In Alabama and North Carolina, for example, their payments total an

7

Charles Rettig, “A message from the Commissioner – Economic Impact Payments: IRS helping 150 million Americans

one payment at a time,” Internal Revenue Service, April 14, 2020,

https://www.irs.gov/newsroom/a-message-from-the-

commissioner-economic-impact-payments-irs-helping-150-million-americans-one-payment-at-a-time.

8

An early, tentative estimate by the New America Foundation found that 6 million people would miss out on automatic

payments because they aren’t required to file tax returns. Estimating this population is difficult and, as the New America

authors acknowledge, estimates are subject to uncertainty. Tara Dawson McGuinness and Gabriel Zucker, “Congress

Appropriated $300 Billion in Relief Payments to Individuals and Families – but Poor Delivery May Prevent Tens of

Millions of Americans from Ever Accessing Them,” New America, April 8, 2020,

https://www.newamerica.org/public-

interest-technology/reports/relief-payments-poor-delivery-may-prevent-tens-of-millions-of-americans-from-accessing/.

9

People with self-employment income greater than $400 are also required to file tax returns.

10

Nina Olson, “Earned Income Tax Credit: Making the EITC Work for Taxpayers and the Government,” Internal

Revenue Service: National Taxpayer Advocate, June 2019,

https://taxpayeradvocate.irs.gov/Media/Default/Documents/2020-JRC/JRC20_Volume3_Final.pdf. Our 12 million

estimate excludes people who likely qualify for these credits.

5

estimated $209 million and $324 million, respectively, or nine to ten times the amount of basic cash

assistance those states provide annually through their Temporary Assistance for Needy Families

(TANF) programs ($20 million and $37 million), our estimates suggest.

11

While many SNAP and Medicaid recipients

file federal income tax returns and hence will

receive their payments automatically, state

agencies are the primary organizations able to

reach those who don’t file.

12

State agencies are

uniquely placed to use existing contact

information to alert eligible people about the

payments and connect them with services to

help them obtain their payment.

13

As state agencies reach out to the 9 million

people, the following groups would be useful

targets for outreach efforts:

• Very low-income children. About 3.2

million of the 9 million people — that is,

more than one-third — are under age 17,

which exceeds their share of the U.S.

population overall (22 percent).

14

(See

Figure 2.) Roughly 1 in 5 of the

households that include these children

participate in TANF as well as SNAP

and/or Medicaid.

• Adults not raising children in their

home. More than 40 percent of the 9

million people are adults without children under age 17. Roughly one-quarter of these

childless adults are themselves under age 25, and could include youth aging out of foster care,

low-income students, and others struggling to get by on their own. Another third of these

11

Center on Budget and Policy Priorities, “State Fact Sheets: How States Spend Funds Under the TANF Block Grant,”

updated February 25, 2020,

https://www.cbpp.org/research/family-income-support/state-fact-sheets-how-states-

spend-funds-under-the-tanf-block-grant.

12

SNAP and Medicaid know which of their participants have income through Social Security, SSI, Veterans Affairs, and

the Railroad Retirement Board and therefore are likely receiving their payment automatically. They will not know which

households are receiving the payment because the household filed a federal tax return in one of the last two years.

13

Because SNAP and Medicaid assistance units don’t align precisely with tax filing units (that is, people who appear on

the same tax return), agency efforts may reach people in multiple tax units, with each tax unit eligible for a payment. For

example, a SNAP household might include a mother and child who are doubled up in the same apartment with the

grandmother and an elderly aunt. This household could represent three tax filing units — each eligible for a payment —

but just one SNAP household if the four individuals purchase and prepare food together.

14

These children may include dependents of people who received automatic payments. Adult recipients of Social

Security, Railroad Retirement, SSI, and veterans’ pension or disability benefits received a payment for themselves but

have to file a 2020 tax return to receive the additional $500 for their dependent, where applicable.

FIGURE 1

6

childless adults are between 50 and 65, and might include people with limited job skills or

disabilities.

• People of color. Twenty-seven percent of the 9 million people are Black — higher than their

share of the U.S. population (12 percent) — while another 19 percent are Latino. Forty-eight

percent are non-Latino white, making them the largest single racial-ethnic group, but this

share is lower than in the U.S. population (61 percent). Ensuring that low-income people of

color receive the payments for which they qualify is especially important given emerging

evidence that they are being hit hardest by both the economic and the health effects of the

pandemic.

15

• People with lower education levels. Some 19 percent of the 9 million people have no

family member with a high school degree, almost three times the rate in the general

population. People with less education are among those especially vulnerable during the

current crisis: almost half of people with a high school degree or less have had someone in

their household lose a job or hours due to the pandemic, and two-thirds report having

insufficient savings to cover three months of bills and expenses in an emergency.

16

• People lacking secure housing. Many individuals who do not have permanent housing have

very low incomes and are likely to be among the non-filer population.

15

Kim Parker, Juliana Menasce Horowitz, and Anna Brown, “About Half of Lower-Income Americans Report

Household Job or Wage Loss Due to COVID-19,” Pew Research Center, April 21, 2020,

https://www.pewsocialtrends.org/2020/04/21/about-half-of-lower-income-americans-report-household-job-or-wage-

loss-due-to-covid-19/; Centers for Disease Control and Prevention, “COVID-19 in Racial and Ethnic Minority

Groups,” updated April 22, 2020, https://www.cdc.gov/coronavirus/2019-ncov/need-extra-precautions/racial-ethnic-

minorities.html.

16

Parker, Menasce Horowitz, and Brown, op. cit.

7

FIGURE 2

Table 1 gives state-by-state estimates of the number of individuals among the 9 million non-filers

who receive SNAP and/or Medicaid, and the resulting funds that would flow into state economies if

payments reached all of them. (See the Appendix Table for more detailed state-by-state estimates of

the subgroup of roughly 6.5 million SNAP recipients who were likely missed by automatic

payments.)

TABLE 1

Estimated Adults and Children Missed by Automatic Payments Who Receive SNAP

and/

or Medicaid Benefits

Total individuals

Potential total payments (in

millions of dollars)

United States

9,270,000

$9,000

Alabama

220,000

$209

Alaska

26,000

$24

Arizona

200,000

$198

Arkansas

110,000

$101

California

1,082,000

$1,035

Colorado

*

*

8

TABLE 1

Estimated Adults and Children Missed by Automatic Payments Who Receive SNAP

and/

or Medicaid Benefits

Total individuals

Potential total payments (in

millions of dollars)

Connecticut

*

*

Delaware

27,000

$28

District of Columbia

35,000

$35

Florida

750,000

$742

Georgia

383,000

$365

Hawaii

33,000

$33

Idaho

*

*

Illinois

312,000

$309

Indiana

162,000

$146

Iowa

*

*

Kansas

*

*

Kentucky

171,000

$162

Louisiana

233,000

$ 221

Maine

*

*

Maryland

*

*

Massachusetts

159,000

$158

Michigan

308,000

$293

Minnesota

*

*

Mississippi

145,000

$133

Missouri

143,000

$140

Montana

19,000

$18

Nebraska

*

*

Nevada

87,000

$83

New Hampshire

*

*

New Jersey

186,000

$182

New Mexico

105,000

$101

New York

625,000

$616

North Carolina

340,000

$324

North Dakota

16,000

$15

Ohio

394,000

$358

Oklahoma

130,000

$126

Oregon

118,000

$113

Pennsylvania

363,000

$337

Rhode Island

30,000

$31

South Carolina

213,000

$194

9

TABLE 1

Estimated Adults and Children Missed by Automatic Payments Who Receive SNAP

and/

or Medicaid Benefits

Total individuals

Potential total payments (in

millions of dollars)

South Dakota

27,000

$24

Tennessee

215,000

$ 213

Texas

685,000

$624

Utah

*

*

Vermont

14,000

$13

Virginia

191,000

$177

Washington

185,000

$179

West Virginia

100,000

$94

Wisconsin

*

*

Wyoming

*

*

*Sample size too small. See the Appendix Table for more detailed state-by-state estimates. Source: CBPP analysis of the

U.S. Census Bureau’s Current Population Survey for 2015-2017, with corrections for underreported SNAP and SSI from

the Department of Health and Human Services/Urban Institute Transfer Income Model (TRIM).

While the 9 million people receiving SNAP and/or Medicaid will be the easiest for states to reach,

3 million other people eligible for payments may be outside the reach of SNAP and Medicaid state

agencies. More than half of them are non-elderly adults not raising children at home.

17

Though some

may receive other state- or locally administered benefits or be connected to community-based

organizations, overall this group tends to be less connected to services and can include people

experiencing job or earnings loss, housing insecurity, or homelessness.

Payments for This Group Can Provide Effective Economic Stimulus

The CARES Act payments are a key pillar of the federal fiscal stimulus measures designed both to

help families cope with the loss of jobs and income in the pandemic and to offset the strong

downward pressure on the overall economy. The payments for the 12 million people at risk of

missing out on them would be particularly effective in boosting economic activity because these

individuals have very low incomes and tend to live close to the edge, spending (rather than saving)

any additional money they receive. High-income people, in contrast, tend not to live paycheck to

paycheck and save at relatively high levels.

Payments to very low-income people are among the most effective ways to stimulate the economy

during a recession, a Congressional Budget Office (CBO) analysis issued during the Great Recession

17

Some childless adults whom our estimates classify as not participating in SNAP may now participate because the

program’s three-month time limit for adults aged 18-50 who aren’t employed or raising minor children has temporarily

been suspended during the public health emergency. See Ed Bolen, “Unemployed Workers Can Get SNAP During

Health Emergency,” Center on Budget and Policy Priorities, April 2, 2020,

https://www.cbpp.org/blog/unemployed-

workers-can-get-snap-during-health-emergency.

10

found.

18

CBO estimated that a tax cut for high-income people would yield 20 to 60 cents of

economic activity (measured by gross domestic product) for every dollar of cost, because relatively

few of those recipients would spend the money. By contrast, a tax cut for low- and moderate-

income people would generate 60 cents to $1.50 of economic activity per dollar of tax cut. CBO also

estimated that an added dollar of SNAP or unemployment insurance would generate 80 cents to

$2.10 in economic activity; these types of stimulus are so effective because both groups tend to be

highly cash-constrained. The 12 million eligible people discussed in this report are arguably even

more cash-constrained, so delivering payments to this group would be extremely effective stimulus.

Governors and State SNAP, Medicaid Agencies Have Key Role

Governors and state agencies that administer SNAP and Medicaid can play a central role in raising

awareness about the payments and connecting non-filers with assistance in getting them. Governors

can direct agencies to use available resources to identify individuals eligible for the payments and

provide support to help this vulnerable group apply. They also can use their leadership positions to

educate the public and organize statewide outreach efforts; governors have led many past outreach

efforts, such as campaigns to promote federal tax refunds, children’s health care coverage, and

immunization campaigns. Governors can drive such efforts through their chief-executive authority,

their convening power, and by leveraging their ability to drive significant earned and unearned media

interest (that is, through traditional press stories and paid advertising). In states that administer

SNAP and/or Medicaid at the county level, county leaders can play a similar role.

State agencies administering SNAP and Medicaid also can help identify people eligible for the

payments and educate them about their eligibility and how to claim the funds. Though many of

these agencies face overwhelming workloads now, incorporating this outreach into their regular

activities would yield a high impact at relatively low cost. These agencies have daily contact with

program participants by phone, in person, or in writing.

Many states have online portals where SNAP or Medicaid recipients can manage their benefits or

report changes; 17 states have already posted to their websites basic information about the payments

and how to apply (see Appendix III), and other states could as well.

19

For example, states can link to

the IRS website and its online form for non-filers to complete in order to receive their payment.

States also can provide educational and outreach materials to other government and nonprofit

service providers. Some states provide application kiosks and staff to assist applicants in their office

lobbies. While most state health and human services offices are currently closed, as they reopen they

could provide access to the IRS non-filer form, as well.

18

All multipliers from Congressional Budget Office, “Estimated Impact of the American Recovery and Reinvestment

Act on Employment and Economic Output From April 2010 Through June 2010,” August 2010,

https://www.cbo.gov/sites/default/files/111th-congress-2009-2010/reports/08-24-arra.pdf

. The U.S. Department of

Agriculture’s (USDA) most recent estimates find that every dollar in new SNAP benefits spent when the economy is

weak and unemployment is elevated would increase gross domestic product by $1.54. See Patrick Canning and Rosanna

Mentzer Morrison, “Quantifying the Impact of SNAP Benefits on the U.S. Economy and Jobs,” USDA, Economic

Research Service, July 18, 2019,

https://www.ers.usda.gov/amber-waves/2019/july/quantifying-the-impact-of-snap-

benefits-on-the-us-economy-and-jobs/.

11

Moreover, state agencies have contact information for program participants and have many

opportunities for direct communication with those potentially eligible. They are in direct written

contact through text, email, and regular mail regarding the participants’ SNAP or Medicaid benefits

and could insert information about how to apply for the payments with those routine

communications. (For example, in an email to 93,000 individuals in households participating in

SNAP and TANF about the availability of free tax preparation services through VITA, Connecticut

Governor Ned Lamont and the Department of Social Services included information about the

EIP.) Agencies are also routinely in contact with some participants over the phone, particularly

through their call centers. Some of the eligible group will have in-depth interactions with these

agencies; for example, a large majority of families participating in state cash assistance programs will

likely be in touch with their caseworker over the summer months to renew their benefits or address

other issues. This type of interaction represents an excellent opportunity for the state to explain a

family’s potential eligibility for the payment and help them apply.

Millions of other individuals contact states via phone or the internet every day. While waiting on

hold at a call center or conducting business online, they could receive information about the

payments and how non-filers can apply. Local human services offices generally inform their

eligibility workers and call center staff about other community resources available to families, such

as local food banks and other community-based resources, and states could include information

about the payments in their materials for eligibility workers so they can provide accurate

information.

To contact some non-filers who might not be connected to SNAP or Medicaid, such as very low-

income adults without children and people who lack secure housing (including those who are

homeless), state agencies can also ask their contracted service providers and other community

partners to reach out. The combined efforts of state and community organizations can vastly

increase the number of eligible people who actually receive their payments.

Governors and state agencies can also help potentially eligible non-filers connect with third-party

organizations that can help them apply accurately and free of charge. Unscrupulous entities and

individuals may try to scam individuals out of their payment; states can use their communication

networks to help push against these fraudulent efforts and direct eligible individuals to trusted

helpers and to correct information.

Community-Based Organizations and Local Officials Also Vital

Community-based organizations and local officials can also play a vital role in helping connect

non-filers to economic impact payments. Both serve as essential outreach channels for the EITC

and other public awareness campaigns. Community organizations such as community action

agencies, faith-based organizations, and religious institutions are connected to many of the 3 million

non-filers who don’t participate in SNAP or Medicaid, so they are key avenues for outreach. In

addition, organizations providing critical services such as food banks and health care likely interact

with harder-to-reach populations that state agencies and other outreach channels may miss. Some

community-based organizations have staff who can help people complete the IRS non-filer form,

which is especially valuable for people without internet access.

Local officials have established platforms they can use to share information about the payments

and how to get them. Mayors and city, county, and town officials are attuned to the needs of their

12

communities and are already working to address challenges that non-filers may face, including

homelessness, language barriers, and lack of internet access. Local officials have connections with

various entities that can disseminate information, such as school districts and utility companies. In

addition to publicizing information about the payments, local officials can help inform people of

local sources for help from community organizations.

Assistance in Accessing Payments Can Increase Receipt

To receive a payment, individuals not receiving a federally administrated benefit must provide

their information to the IRS no later than October 15 if filing a tax return or by November 21 if

using the simplified IRS online form for people who aren’t required to file a tax return, known as

the “Non-filer” tool.

20

The tool requires a user to create an online account, enter personal

information (including direct deposit information, if available), verify their email address, and submit

the form. Some individuals who do not typically file a return may find this process hard to complete

without assistance even during normal times, and especially during a pandemic.

While the simplified form requires much less information than filing a full tax return, individuals

must have internet access, an email address, a direct deposit account or an address to which the

payment can be delivered, and facility with the online form and account. For individuals with little or

no income, disabilities, or limited contact with public agencies, any of these elements may be

challenging.

Normally, agencies could direct people to free taxpayer assistance services such as Volunteer

Income Tax Assistance (VITA) sites for help. With most VITA sites closed due to COVID-19,

some are offering online services to low-income taxpayers during the pandemic to help filers and

non-filers navigate their IRS requirements. Since the IRS is not currently processing paper tax

returns, all non-filers will have to submit their information electronically in order to receive their

payment in a timely manner. Many non-filers will need help from agencies or these online tax

assistance services to submit complete and accurate tax forms and avoid delays with their payment.

The most expedient way to receive a payment is through direct deposit to a bank account, a

financial payment app (such as Venmo, PayPal, or Cash App), or a prepaid debit card. When

individuals include their direct deposit information on their simplified form, the IRS typically

delivers the payment within one to two weeks if no errors arise with the routing information. For

individuals for whom the IRS does not receive direct deposit information the IRS will mail a paper

check or, in some cases, a prepaid debit card.

21

Many non-filers may need assistance establishing a bank account or an alternative account that can

receive direct deposits. An estimated 14 percent of people with incomes below $40,000 are

“unbanked” (meaning they lack a checking, savings, or money market account), and the share is

20

Internal Revenue Service, “Non-Filers: Enter Payment Info Here,” updated May 18, 2020,

https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here

.

21

Department of the Treasury, “Treasury is Delivering Millions of Economic Impact Payments by Prepaid Debit Card,”

May 18, 2020, https://home.treasury.gov/news/press-releases/sm1012

.

13

likely even higher among non-filers who do not regularly receive federal benefit payments.

22

Bank

accounts through certain institutions can be opened online. Several financial apps also address this

gap and provide avenues for people to receive direct deposits to their account within the app.

22

Board of Governors of the Federal Reserve, “Report on the Economic Well-Being of U.S. Households in 2019,

Featuring Supplemental Data from April 2020,” May 2020,

https://www.federalreserve.gov/publications/files/2019-

report-economic-well-being-us-households-202005.pdf.

14

Appendix I

This Appendix Table displays state-by-state estimates of the subgroup of the 9 million people

eligible for payments who receive SNAP (whether or not they receive Medicaid) based on

administrative data. See Appendix II for more detail.

APPENDIX TABLE

Estimated People Missed By Automatic Payments Who Receive SNAP Benefits

Households Individuals

Potential value

of payments

Total Total Under 17 years

In millions of

dollars

United States

3,270,000

6,534,000

3,024,000

$5,700

Alabama

45,500

99,600

47,700

$86

Alaska

7,900

17,700

7,700

$16

Arizona

68,500

133,000

56,300

$120

Arkansas

20,800

46,800

23,500

$40

California

543,600

1,095,100

548,900

$930

Colorado

35,200

78,700

42,200

$65

Connecticut

39,100

65,400

22,800

$63

Delaware

11,300

22,800

11,100

$20

District of

Columbia

13,200 23,500 9,300 $22

Florida

245,800

437,400

184,000

$396

Georgia

151,800

330,400

158,500

$286

Hawaii

12,100

22,800

9,500

$21

Idaho

7,300

18,800

10,800

$15

Illinois

172,000

315,900

129,200

$289

Indiana

34,600

79,200

39,900

$67

Iowa

26,300

55,600

27,900

$47

Kansas

9,100

21,600

11,800

$18

Kentucky

49,700

95,900

36,400

$90

Louisiana

48,300

113,300

60,400

$94

Maine

6,900

14,900

6,900

$13

Maryland

67,300

121,800

50,000

$111

Massachusetts

56,100

108,200

48,200

$96

Michigan

93,500

159,100

53,100

$154

Minnesota

26,100

49,500

27,100

$40

Mississippi

41,600

88,800

40,800

$78

Missouri

38,400

86,300

45,700

$72

Montana

5,100

11,600

5,400

$10

Nebraska

9,600

20,900

11,000

$17

15

APPENDIX TABLE

Estimated People Missed By Automatic Payments Who Receive SNAP Benefits

Households Individuals

Potential value

of payments

Total Total Under 17 years

In millions of

dollars

Nevada

38,300

69,700

28,400

$64

New Hampshire

4,400

9,900

4,900

$8

New Jersey

66,800

139,800

76,800

$114

New Mexico

27,000

56,800

25,200

$51

New York

188,600

351,200

152,500

$315

North Carolina

120,900

241,400

110,200

$213

North Dakota

3,400

8,400

4,400

$7

Ohio

92,900

179,800

78,100

$161

Oklahoma

31,100

74,000

38,200

$62

Oregon

50,600

92,700

34,400

$87

Pennsylvania

105,500

211,700

95,200

$187

Rhode Island

11,200

19,900

7,700

$18

South Carolina

58,500

134,200

68,900

$113

South Dakota

5,500

13,900

7,600

$11

Tennessee

80,700

161,400

70,100

$145

Texas

290,500

610,000

300,700

$521

Utah

13,900

33,200

18,600

$27

Vermont

2,500

5,100

2,300

$4

Virginia

53,000

126,000

65,700

$105

Washington

68,900

118,800

47,100

$110

West Virginia

25,100

50,800

20,600

$47

Wisconsin

34,800

67,800

28,500

$61

Wyoming

1,800

4,700

2,500

$4

Source: CBPP analysis of USDA SNAP Household Characteristics data for fiscal years 2016

-2018.

Note: We estimate that about 12 million people will be missed by automatic payments; of

these, about 9 million people receive SNAP

and/or Medicaid. The figures shown here represent the subgroup of the 9 million who receive SNAP, whether or not they receive

Medicaid.

16

Appendix II: Estimating the Outreach Population for Economic Impact

Payments

Table 1 in this paper relies on nationally representative survey data to estimate the number of

individuals eligible for Economic Impact Payments while excluding those likely to receive those

payments automatically because they filed federal income taxes

23

or participate in federal benefit

programs (Social Security, Railroad Retirement, SSI, or veterans’ pensions or disability benefits). The

estimates are approximate and are affected by underreporting of income and benefits, recent

changes in program participation, and other data limitations.

Data reflect the population, economy, and program participation patterns of 2015 through 2017

and are from CBPP’s analysis of the Census Bureau’s Current Population Survey (CPS) Annual

Social and Economic Supplement, adjusted to correct for underreporting of SNAP and SSI

participation in the CPS using baseline data from the Transfer Income Model Version 3 (TRIM 3).

TRIM 3 is developed and maintained by the Urban Institute with primary funding from the

Department of Health and Human Services Office of the Assistant Secretary for Planning and

Evaluation (HHS/ASPE). To improve the reliability of the state estimates, we average together three

years of data (2015 through 2017), the most recent available from TRIM. We exclude immigrant

families likely to be ineligible due to lacking a Social Security number.

Our SNAP results in the Appendix Table are from CBPP’s analysis of USDA SNAP household

characteristics data for fiscal years 2016-2018. Because of data limitations (SNAP records do not

include annual income or tax filing status), we limit the sample to those making less than the tax

filing threshold on a monthly basis and exclude those who might qualify for the EITC or Child Tax

Credit based on earnings, monthly income, age, and family composition; we also exclude family

members of certain SNAP-ineligible immigrants who didn’t report a Social Security number. To err

on the conservative side, the figures exclude families that receive SNAP for less than 12 months

because such families are especially likely to have worked and earned more in the months before

entering the program, and thus to have filed taxes for the year. The figures also (conservatively)

exclude families where any family member received Social Security, SSI, or veterans’ pensions or

disability benefits.

23

The CPS does not ask respondents about their income taxes, but the Census Bureau estimates taxes and tax filing

status from survey data on income, age, and family relationship. We start with Census tax status indictors and modify

them to include additional potential tax dependents not captured in the Census tax model. For example, we count elderly

parents who live with their higher-earning children as dependents if they meet IRS dependency rules. Also, when college

students live with no family members, we assume their parents claim them as dependents if the students are under age

24, attend school full time, and have income below $4,150 in 2018 dollars. These adjustments raise the estimated

number of filers, spouses, and dependents in tax year 2017 from 286 million using Census’ tax indicators to 291 million,

which is closer to the actual figure of 293 million listed by IRS (https://www.irs.gov/pub/irs-soi/17in23ar.xls

). The

remaining persons — that is, those not considered to be a tax filer, spouse, or dependent, totaling 31.7 million in the

CPS data for 2017 — are the non-filing population. Of those, an estimated 12 million are eligible for Economic Impact

Payments and we consider them the outreach population.

As a check, we modeled the outreach population in another Census survey, the Survey of Income and Program

Participation, which has better data on which college students can be claimed as dependents (as well as on certain other

elements of the calculation, such as immigration status and who receives Social Security benefits). Those calculations

also show about 12 million people in the outreach population nationwide in 2016.

17

Appendix III: Resources

Federal Agency Information

• IRS Non-filer tool: https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here

• IRS E-file 2019 tax return: https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-

free

• IRS Volunteer Income Tax Assistance (VITA) locator: https://irs.treasury.gov/freetaxprep/

• Social Security Administration: https://www.ssa.gov/coronavirus/#anchorA

• Department of Veterans Affairs: https://www.va.gov/coronavirus-veteran-frequently-

asked-questions/

National Organization Information:

• Virtual Volunteer Income Tax Assistance help: www.getyourrefund.org

• E-File 2019 tax return: MyFreeTaxes.com

• CBPP EIP outreach information: https://www.eitcoutreach.org/tax-filing/coronavirus/

• University of Michigan stimulus payment guide (applicable nationwide):

https://poverty.umich.edu/stimulus-checks/

• City of Durham, NC stimulus payment guide (applicable nationwide):

https://www.getyour1200durham.org/

State health and human service agency information (examples):

• California: https://www.ftb.ca.gov/about-ftb/newsroom/covid-19/help-with-covid-

19.html#COVID-19-Economic-impact-payments-CARES-Act

• Connecticut: https://portal.ct.gov/DRS/COVID19/DRS-COVID-19-Response-

FAQ#FSC

• Florida:

https://floridarevenue.com/childsupport/compliance/Pages/economic_impact_payment_o

ffsets.aspx

• Hawaii: https://tax.hawaii.gov/covid-19/

• Illinois: https://www2.illinois.gov/rev/Pages/Information-Regarding-Federal-Economic-

Impact-Payments.aspx

• Maine: https://www.maine.gov/dhhs/ofi/dser/stimulus-faq.shtml

• Michigan: https://www.michigan.gov/documents/difs/Stimulus_Info_687081_7.pdf

• Nevada: https://dwss.nv.gov/Support/FAQs_Economic_Impact_Payments/

• New Hampshire: https://www.dhhs.nh.gov/dcss/documents/bcss-fto-and-ui-042020.pdf

18

• New Jersey: https://covid19.nj.gov/faqs/nj-information/general-public/how-does-the-

cares-act-stimulus-package-help-me-or-my-business-how-do-i-get-my-economic-impact-

payment

• New York: https://www.tax.ny.gov/press/alerts/stimulus-checks-information.htm

• North Carolina: https://files.nc.gov/ncdhhs/NC2020-Stimulus-Updated-FAQs.pdf

• North Dakota: https://www.nd.gov/tax/covid-19-tax-guidance/

• Pennsylvania: https://www.dhs.pa.gov/providers/Providers/Pages/economic-stimulus.aspx

• Rhode Island: http://www.tax.ri.gov/Advisory/ADV_2020_17.pdf

• Vermont: https://dcf.vermont.gov/dcf-blog/covid19-payments