Updated May 12, 2021

EIP3 Frequently Asked Questions

When will federal benefit recipients receive EIP3?

On April 7

th

, direct deposit payments began to post for SSDI and SSI recipients and retired

railroad workers, many of whom automatically qualify for the third check. Those who do not

receive their payments as a direct deposit will receive their payments in the mail over the

following weeks.

Those who receive veterans benefits started to receive EIP3 on April 14

th

. VA beneficiary

payment information may not yet be available in the Get My Payment tool

, and the IRS is

looking into this.

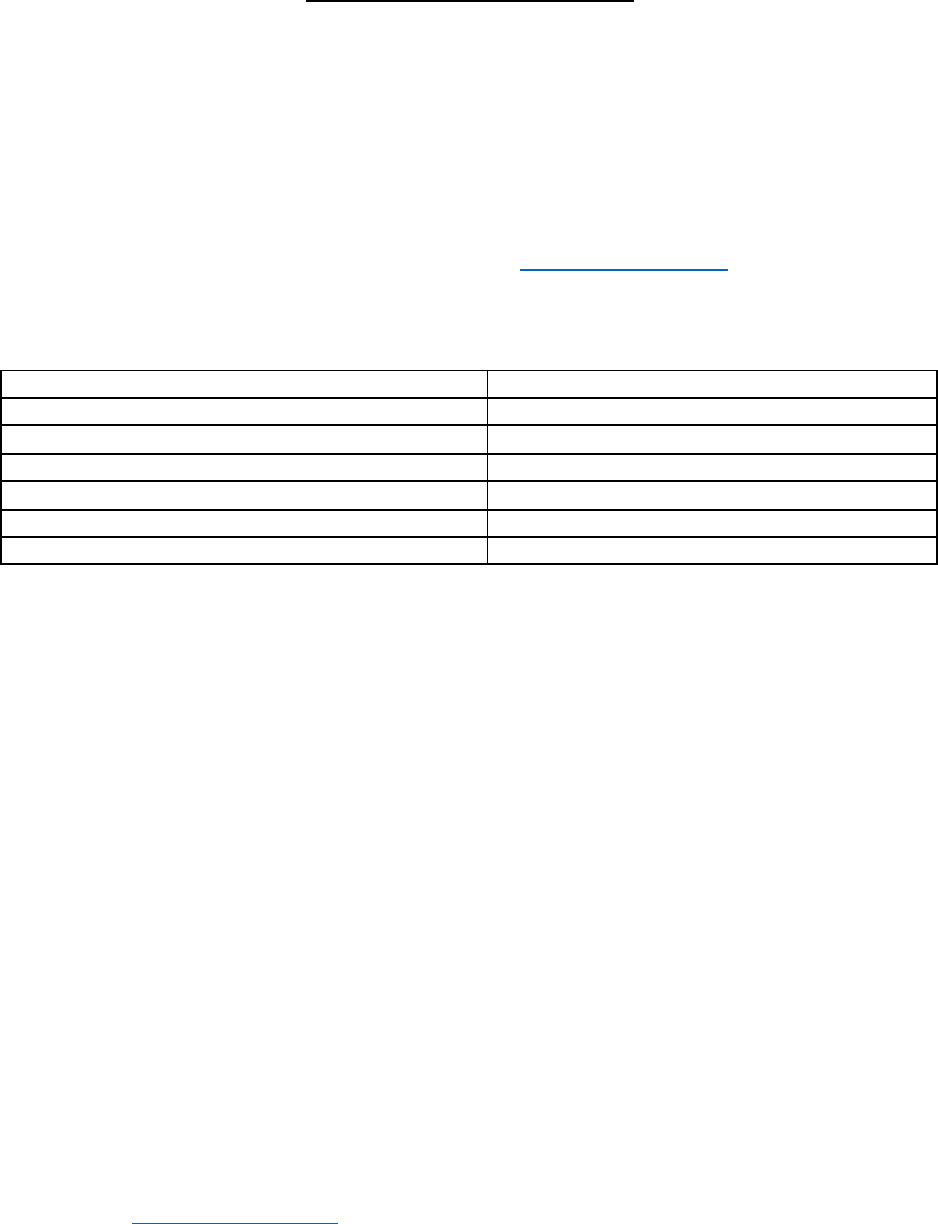

Payment timeframe:

First direct deposits issued

March 11, 2021

First paper checks mailed

Week of March 15, 2021

First EIP debit cards mailed

Week of March 22, 2021

First payments to SSI and SSDI beneficiaries issued

April 7, 2021

First supplemental (plus-up) payments issued

Weekend of April 3, 2021

First payments to VA beneficiaries issued

April 14, 2021

IRS deadline to issue all EIP3 payments

December 31, 2021

Am I eligible for a supplemental payment based on new information in my 2020 tax return?

The amount of the third payment is based on your latest processed tax return from either 2020

or 2019. If your 2020 return hasn’t been processed, the IRS used 2019 tax return information to

calculate the third payment. If the third payment is based on the 2019 return, and is less than

the full amount, you may qualify for a supplemental payment (“plus-up”). After your 2020

return is processed, the IRS will automatically re-evaluate your eligibility using your 2020

information. If you’re entitled to a larger payment, the IRS will issue a supplemental payment

for the additional amount.

Plus-up payments will continue on a weekly basis as the IRS processes 2020 tax forms and

reevaluates checks. If you got your stimulus payment via direct deposit, that's how you'll get

your plus-up money, too. If the IRS doesn't have your details on file, you may receive a paper

check instead.

What should I do if I do not receive my payment?

If you are concerned that your EIP3 payment is missing or lost, you can request an IRS payment

trace. You can request a payment trace under 2 circumstances:

• If you receive Notice 1444, Your Economic Impact Payment from the IRS but you never

received your payment. You will need the information in the notice to file your claim.

• If the Get My Payment tool

says your payment was sent but you don't have it, you can

request a payment trace on the following timeline:

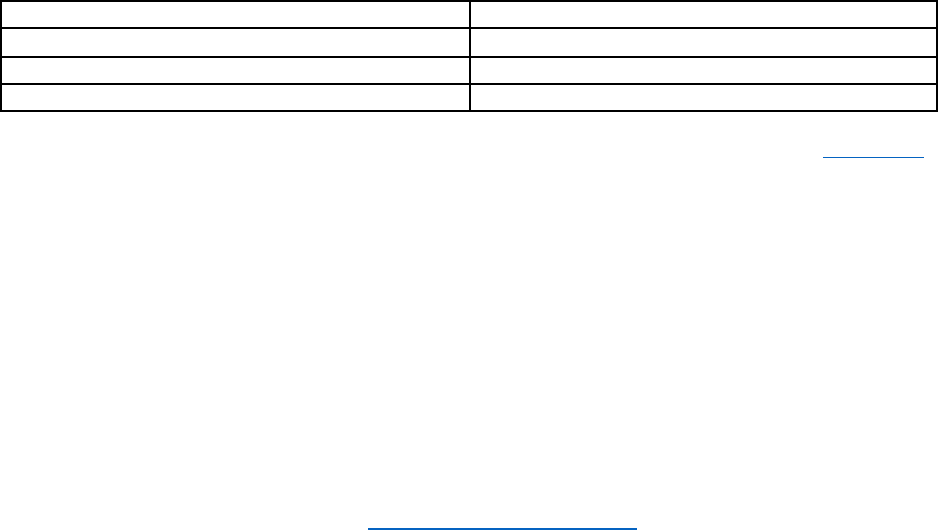

Updated May 12, 2021

Direct Deposit

5 days passed since payment date

Check mailed to address

4 weeks passed since payment date

Check mailed to forwarded address

6 weeks passed since payment date

Check mailed to foreign address

9 weeks passed since payment date

To request a payment trace, call the IRS at 800-919-9835 or mail or fax a completed Form 3911

to the IRS. Write "EIP3" on the top of the form, and when completing item 7 under Section 1:

• Check the box for "Individual" as the Type of return.

• Enter "2021" as the Tax Period.

• Do not write anything for the Date Filed.

You must sign the form, and if you're married and file jointly, both spouses must sign the form.

Do not mail Form 3911 if you've already requested a trace by phone. And do not request a

payment trace to determine your eligibility for EIP or to confirm the amount you should have

received.

If the EIP check was not cashed, the IRS will issue a replacement. If the check was cashed, you

will be sent a claim package from the Bureau of the Fiscal Service

, which will include a copy of

the cashed check. Follow the enclosed included instructions, and the bureau will review your

claim and the signature on the check before deciding if a replacement will be issued.

You should receive a response from the IRS approximately 6 weeks after your request for a

payment trace is received, though it may take longer given the reduced staffing levels at the IRS

as a result of the pandemic.

Will I be able to receive additional money for my dependents?

Yes, most people will get $1,400 for themselves and $1,400 for each of their qualifying

dependents claimed on their tax return. Unlike the first two payments, the third stimulus

payment is not restricted to children under 17. Eligible families will get a payment based on all

of their qualifying dependents claimed on their return, including older relatives like college

students, adults with disabilities, parents and grandparents.

Some federal benefit recipients (SSI, SSDI, VA) may need to file a 2020 tax return, even if they

don't usually file, to provide information the IRS needs to send payments for any qualified

dependent. Eligible individuals in this group should file a 2020 tax return as quickly as possible.

For taxpayers who file jointly and only one individual has a valid SSN, the spouse with a valid

SSN will receive up to a $1,400 third payment and up to $1,400 for each qualifying dependent

claimed on their 2020 tax return. For taxpayers who don’t have a valid SSN, but have a

qualifying dependent who has an SSN, they will receive up to $1,400 for a qualifying dependent

claimed on their return if they meet all other eligibility and income requirements. If either

spouse was an active member of the U.S. Armed Forces at any time during the taxable year,

Updated May 12, 2021

only one spouse needs to have a valid SSN for the couple to receive up to $2,800 for

themselves, plus up to $1,400 for each qualifying dependent.

If married taxpayers filing jointly did not receive one or both of the first two Economic Impact

Payments because one spouse didn’t have a Social Security number valid for employment, they

may be eligible to claim a 2020 recovery rebate credit

on their 2020 tax return for the spouse

with the SSN valid for employment.

How will the IRS know where to send my payment? What if I changed bank accounts?

The IRS will use data already in its systems to send the third stimulus payments.

Taxpayers with direct deposit information on file will receive the payment that way.

Those without current direct deposit information on file will receive the payment as a check or

debit card in the mail.

Can the IRS withhold my EIP3 for a debt I owe?

Under the new law, an EIP3 cannot be offset to pay various past-due federal debts or back

taxes. However, private debt collectors may be able to take your EIP3 funds if they have a lien

on your bank account.

If I received my first and second payments on EIP Cards, will EIP3 be deposited on one of my

previous cards?

No. New EIP Cards will be issued. The earlier EIP Cards will not be reloaded. You can find

information about EIP cards here

.

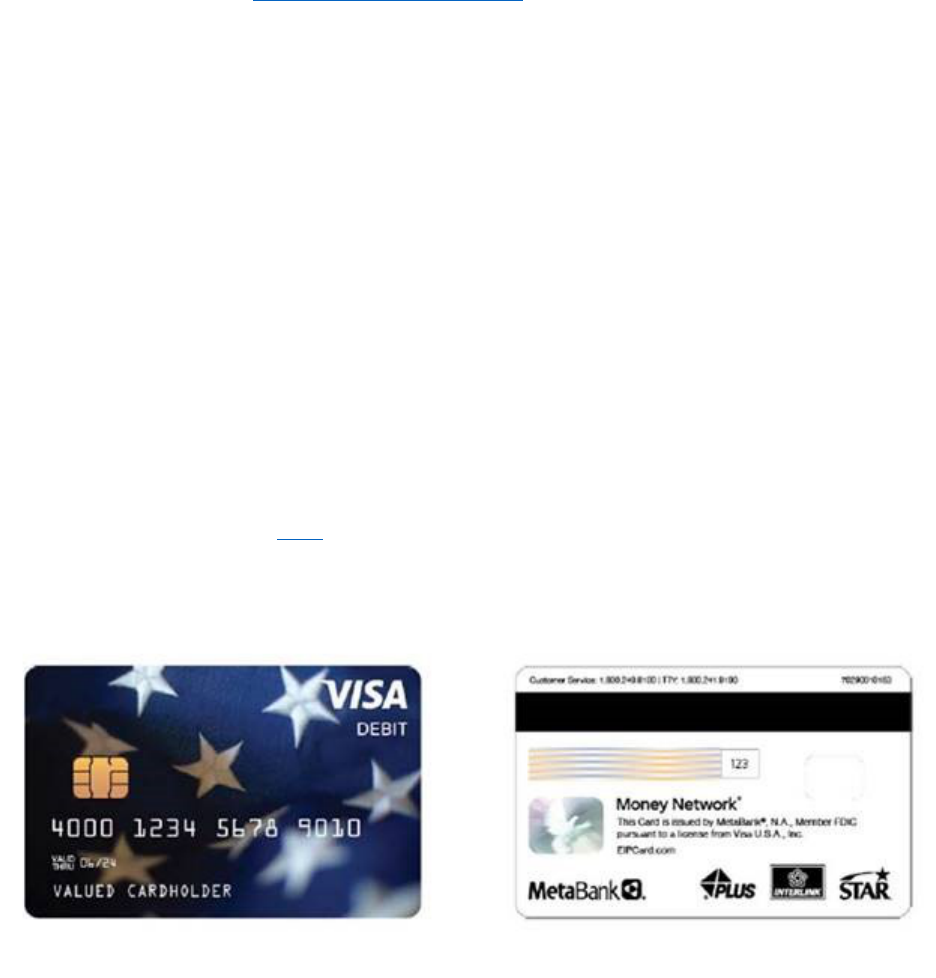

What does an EIP card look like?

Updated May 12, 2021

How can I transfer funds from my EIP Card to a bank account?

To transfer funds:

• Call 1-800-240-8100 to activate EIP Card.

• Register for online or mobile app access by going to EIPCard.com or the Money Network

Mobile App2 and click on “Register.” Follow the steps to create a user ID and password.

• Select “Move Money Out” and follow the steps to set up ACH transfer. Transfers should

post to your bank account in 1-2 business days.

What if my EIP Card is lost or stolen?

If you have misplaced your EIP Card, you can lock your card by logging into your EIP Card

account at EIPCard.com to prevent unauthorized transactions or ATM withdrawals while you

look for it. If your EIP Card is permanently lost, call customer service at 1-800-240-8100 to

report the lost or stolen EIP Card. Your EIP Card will be deactivated to prevent anyone from

using it and a new replacement EIP Card will be ordered at no additional fee.

What if I accidentally threw away my EIP Card?

If you accidentally threw away your EIP Card, call customer service at 1-800-240-8100 to report

the lost card and request a free replacement. The discarded card will be deactivated.