QUARTERLY SCAM UPDATE

Issue 3

OFFICE OF THE INSPECTOR GENERAL

SOCIAL SECURITY ADMINISTRATION

October 1, 2021 – December 31, 2021

Social Security-Related Scams

The Social Security Administration (SSA) and SSA

Office of the Inspector General (OIG) continue to

receive reports of scammers impersonating

government employees or alleging a Social

Security-related problem to steal money or personal

information from victims.

Since October 2019, SSA OIG has shared

information on our efforts to combat Social

Security-related scams with the House Committee

on Ways and Means, Social Security

Subcommittee; Senate Committee on Finance; and

Senate Special Committee on Aging. We began

publicly releasing the Quarterly Scam Update for

the third quarter (April 1, 2021, through June 30,

2021) of Fiscal Year (FY) 2021 to provide

information about these scams and our efforts to

combat them.

This report addresses trends in Social Security-

related scam allegations, as well as our ongoing

efforts to raise public awareness of, and disrupt the

scams in the first quarter (Q1) of FY 2022

(October 1, 2021, through December 31, 2021).

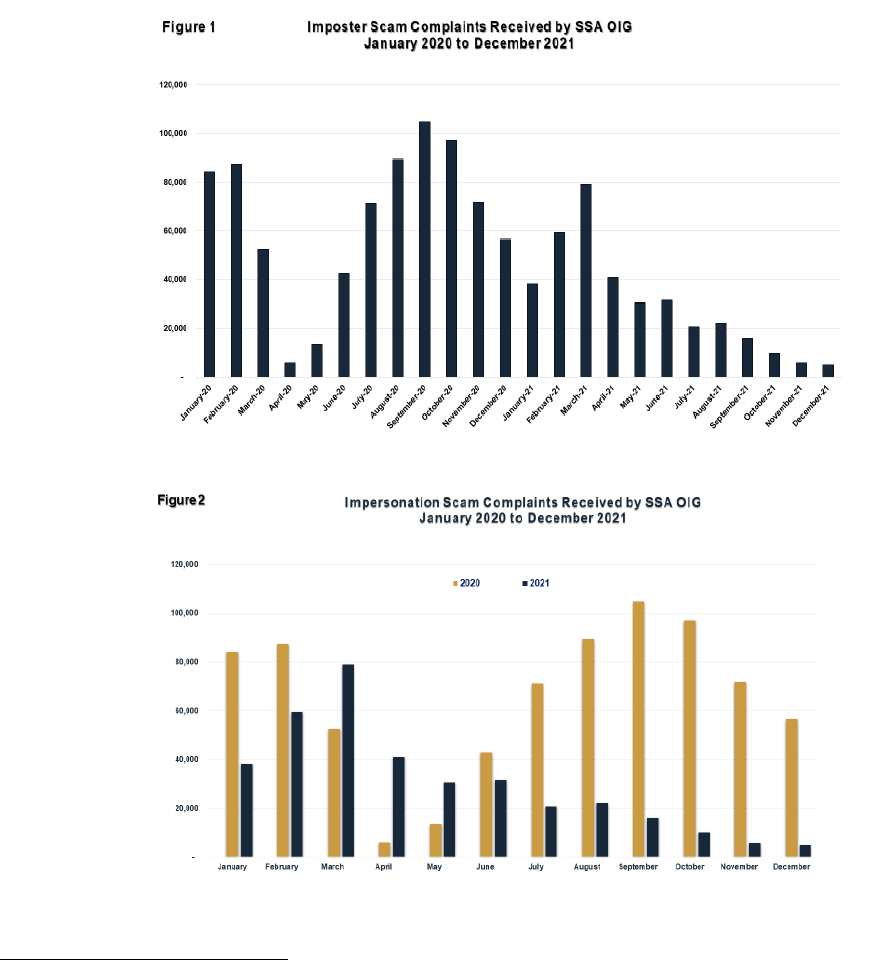

Volume of Social Security-Related Scam Allegations in Q1

OIG received fewer reports

1

of Social Security-related

2

scams during Q1 of FY 2022 than any quarter since

Q2 of FY 2020. In December 2021, we received approximately 5,000 scam allegations, one-third of the

volume in September 2021, the last month in Q4 of FY 2021 (Q4). Our December volume of allegations

also reflects a 91 percent decrease from December 2020, when we received approximately 57,000 scam

allegations.

The following figures show the trends in two different formats, as well as general scam trends for the past 24

months.

3

1

The number of Social Security-related scam allegations OIG receives may not reflect all Social Security-related

scams. This is because the allegations are self-reported. For the same reason, allegations of financial losses to

scammers may not reflect actual losses.

2

These scams primarily use the telephone, but a small number of scams are reported to have been perpetuated

through email, social media, text message, or U.S. mail.

3

We have been tracking Social Security-related scam allegations since April 2018. We launched the dedicated online

reporting form in November 2019, which increased our ability to track scam reports.

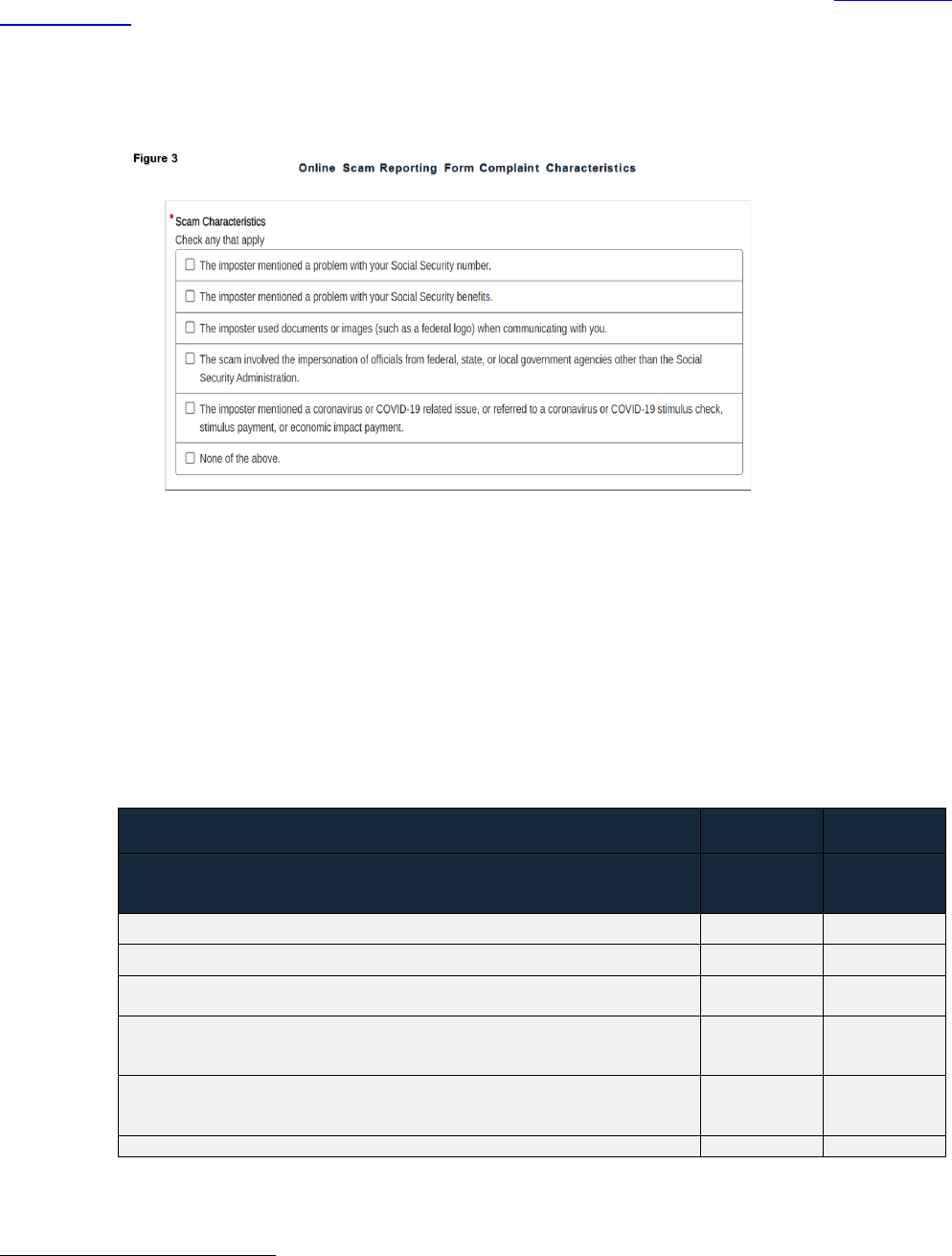

Sources of Information

We receive the majority of Social Security-related scam allegations from OIG’s dedicated online scam

reporting form.

4

Among other questions, the form asks complainants to check whether any of six

characteristics of scams apply to their complaint. Figure 3, below, lists the six characteristics. The form also

asks the complainant’s state of residence, age, whether the individual experienced a financial loss, the

amount of the loss, and the method the imposter used to contact the individual, such as by telephone, email,

or other means.

Table 1, below, compares responses to the six complaint characteristics in Q1 FY 2022 and Q4 FY 2021. In

both quarters, imposters mentioning problems with the complainant’s Social Security number (SSN) was the

most common complaint characteristic. However, in Q1 FY 2022, 56.1 percent of complainants indicated

that imposters mentioned problems with their SSN, compared with 72.7 percent in Q4 FY 2021. The next

most common complaint characteristic was imposters impersonating government officials. In both quarters,

approximately 42 percent of complainants made this assertion.

Table 1: FY 2021 and Q1 FY 2022 Complaint Trends

Percentage of Total Imposter Allegations from the Scam Reporting Form

FY 2021

FY 2022

Complaint Characteristics

Q4

7/1/21-

9/30/21

Q1

10/1/21 –

12/31/21

The imposter mentioned a problem with your Social Security number

72.7%

56.1%

The imposter mentioned a problem with your Social Security benefits

14.9%

14.7%

The imposter used documents or images (such as a federal logo) when

communicating with you

5.2% 8.6%

The scam involved the impersonation of officials from federal, state, or

local government agencies other than the Social Security

Administration

42.1% 41.5%

The imposter mentioned a coronavirus or COVID-19 related issue, or

referred to a coronavirus or COVID- 19 stimulus check, stimulus payment,

or economic impact payment

1.6% 2.7%

None of the Above

10.3%

20%

Note: The percentages were calculated based on the total number of allegations each quarter. The percentages

do not add to 100 percent because individual allegations may include more than one complaint characteristic.

4

We also receive allegations from other sources, including OIG’s Hotline and directly from SSA employees.

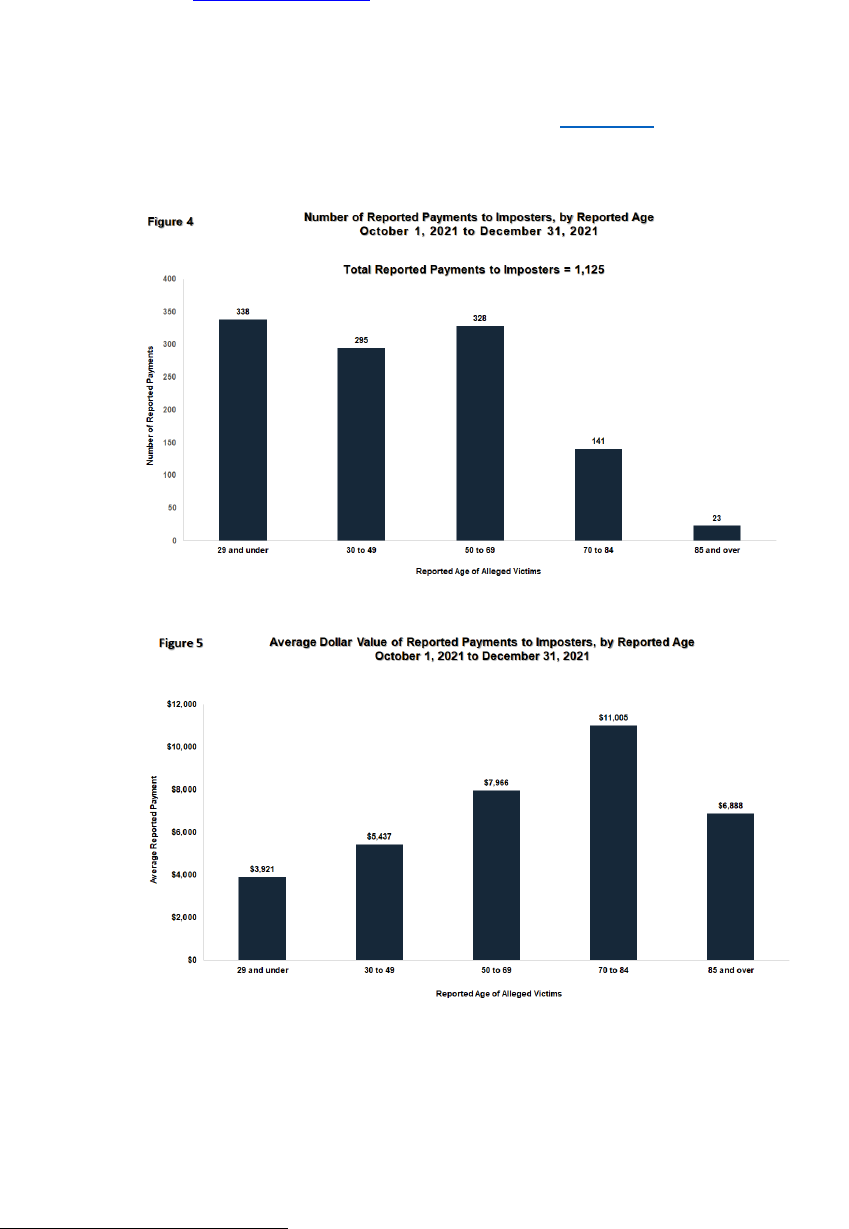

Loss Frequency and Amount by Age

Consistent with our previous reporting

, more individuals under 50 years of age reported financial losses to

scammers than those 50 and older. However, individuals 50 and older reported losses that were higher than

those under 50. Figures 4 and 5, below, break down these trends further for Q1 FY 2022. The graphs are

based upon data from complainants who voluntarily self-reported both a date of birth and a dollar value loss.

These trends continue to be consistent with earlier trends reported by the Federal Trade Commission (FTC)

(and referenced in the Inspector General’s January 2020

testimony on imposter scams before the Senate

Special Committee on Aging).

5

5

Inspector General Ennis testified that according to the FTC, in FY 2019, about 81 per 100,000 people ages 20-29

years old reported a fraud loss to the FTC due to government imposter scams. For those ages 80 years or older, the

rate was about 40 per 100,000. However, the median fraud loss amount for those ages 20-29 was $1,000, while for

ages 80 and over, it was $3,000.

First Quarter FY 2022 (October 1, 2021 – December 31, 2021) Initiatives to

Combat Social Security-related Scams

OIG combats Social Security-related scams by investigating scam allegations and engaging in public outreach

to inform citizens how to recognize, respond to, and report scams. Below are some investigative and outreach

highlights from this reporting period.

• Six Defendants Indicted for Fraud that Included Targeting Elderly Citizens: On November 19, 2021,

Vikas Mehta, Walter Valdivia, Pradip Parikh, Jaime Salas, Alpesh Patel, and Darash Shah were indicted in

the Northern District of Georgia for wire fraud conspiracy, wire fraud, money laundering conspiracy, and

money laundering. The defendants and their co-conspirators allegedly participated in a predatory scheme

defrauding elderly and vulnerable victims nationwide, causing millions of dollars in loss. Mehta and his

fellow-conspirators allegedly used various scams to defraud their victims, including pretending to be an

SSA employee claiming that the victim’s SSN was compromised in some way. The scammer would then

tell the victim that as a result, they needed to pay money immediately or, if they did not, they would be

arrested. The scammer sometimes used names of actual SSA employees to appear legitimate. You can

read more about the case here

.

• Investigation Update – Robocall Conspirators Sentenced: On December 14, 2021, Zeeshan Khan

and Maaz Shamsi, both Indian nationals, were sentenced in the U.S. District Court of New Jersey to 27

months of imprisonment; they previously pleaded guilty

to one count of conspiracy to commit wire fraud.

As part of an international fraud scheme, call centers, believed to be in India, used automated robocalls

with the intent of defrauding thousands of U.S. residents, particularly the elderly. Callers claimed they

were from a U.S. government agency such as SSA, or impersonated law enforcement officers from the

Federal Bureau of Investigations or the Drug Enforcement Administration. They used various schemes to

coerce victims into sending cash through physical shipments or wire transfers to other members of the

conspiracy, including Shamsi and Khan. Shamsi and Khan were charged with receiving an aggregate

$618,000 in fraudulent wire transfers from 19 victims across the country. You can read more

here.

• Inspector General Ennis Warns of Newest Imposter Scam Tactic: Inspector General Ennis issued a

scam alert

on December 13, 2021, to advise the public about an emerging Social Security-related scam

that uses fraudulent SSA letterhead to feign legitimacy to gain trust and target individuals for money or

personal information. The alert advised that scammers are using U.S. mail delivery to send fraudulent

letters, advising the recipient to call a toll-free number to activate an increase in SSA benefits, such as a

cost-of-living adjustment (COLA). The letters appear to be from an SSA official and are designed to look

like real SSA letterhead; however, they are not from SSA. Inspector General Ennis also reminded the

public that the COLA is automatic for all SSA beneficiaries and does not require activation. Further, the

alert reminded that Inspector General Ennis

previously warned about scammers using the real names of

SSA and OIG officials, on March 2, 2021. The press release encourages the public to visit ssa.gov

for

contacts and assistance.

• Slam the Scam Day Preparation: OIG is working to secure our partnerships and plans for our third

Annual Slam the Scam Day on March 10, 2022. We are working with SSA, other federal agencies, and

private sector partners to maximize our impact. For copies of our press release, social media templates,

resources, event information, and more, please see our Slam the Scam Day press kit

.

• SSA’s Public Mailings: In Q1 FY 2022, SSA initially mailed 94 million letters to the public, with a

fraud message printed on the back of all envelopes. As of the date of publication of this report,

March 8, 2022, the Agency had mailed approximately 513.8 million of these letters in total.

Please contact us with any questions: [email protected]

Follow us on social media:

Twitter: @TheSSAOIG • Facebook: OIGSSA • YouTube: TheSSAOIG

OIG.SSA.GOV